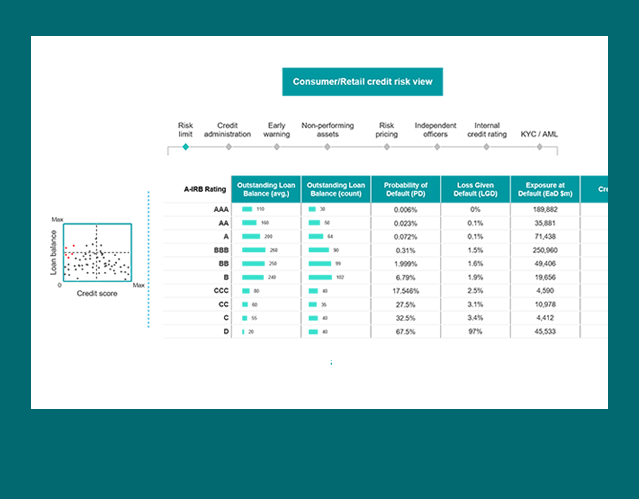

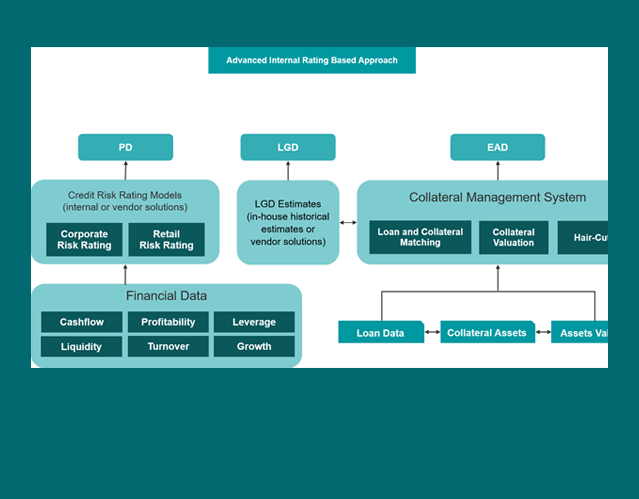

Banking and Credit command center, robust internal controls and risk management system

Analyze exposure, occurrence and impact; improve risk insight, intelligence, management and planning; and streamline capital and risk reporting to reduce residual risk and align with BCBS driven principles.

Home

Home