Our Engagement Model

Our Engagement Model

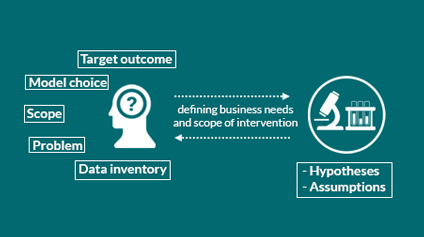

1. The business problem

It starts with an exploratory view of your goal and business problem

- Defining the business problem, scope and desired outcome

- Defining the analytical model that leads to the desired outcome

- Examining available data to be used in the analytical model

2. Hypotheses

Formulating a hypothesis that will guide our intervention.

- Working out a set of hypotheses to lead the intervention

- Identifying the assumptions “ruling” “attached to” the hypotheses

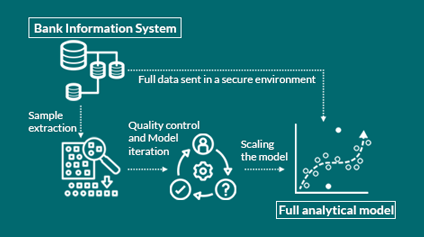

3. Proof of concept

Establishing a proof of concept by:

- Performing an exploratory data analysis and identifying key data that explains variations in outcome

- Building the MVAM - Minimum Viable Analytical Model on a sample data set

4. Full analytical model

- Developing the full model that includes the comprehensive data set

- Producing a report of the results and main recommendations

- Deciding whether the analytical model should be integrated into the bank's IS

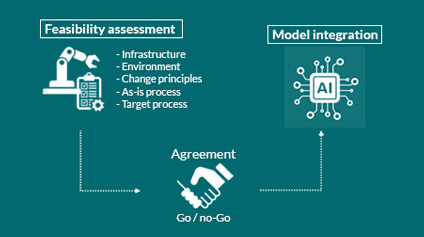

5. Automation pre-assessment

After delivering the analytical model successfully, and if the partner decides to implement the model within the Bank's MIS, we proceed with:

- Examining the environment, functional and nonfunctional requirements, to enable the successful integration of the analytical model into the bank’s IT system and processes

- Estimation of the feasibility and cost of integration

6. Development and integration

The previous step leads to establishing the feasiblility of automating the model, and whether we should go with:

- Designing and setting up the architecture of the application (automated analytical model)

- Developing API endpoints to replicate the analytical process and presentation of the results

- Deploying AI / Machine learning / Analytics model into production